Have you ever felt that you have spent a lot in a month and then suddenly you have to buy some important item? In such a situation, if your pocket is light and the need is heavy, then Flipkart Pay Later can be a great option for you. This facility is for those who do not want the hassle of EMI or loan, but still want to postpone the payment for a few days.

What is Flipkart Pay Later

Flipkart Pay Later is a credit facility that Flipkart provides to its users. Through this you can shop now and pay later by a certain date. You can consider it as a type of small digital loan which is given on easy terms. Under this facility, Flipkart gives you a limit which you can repay at the end of every month or in the form of EMI.

How to Activate Flipkart Pay Later

If you are wondering how to activate it, don’t panic. The process is very simple.

Step 1: Open the Flipkart app and log in to your account.

Step 2: Go to the “My Account” section and click on the “Flipkart Pay Later” option.

Step 3: You will now be asked for basic details like PAN card number and mobile number linked with Aadhaar.

Step 4: Do the OTP verification and you will get the Flipkart Pay Later limit within a few seconds.

If you are not eligible, Flipkart will tell you the reason or give you the option to reapply later.

How to shop with Flipkart Pay Later

Suppose you have activated Flipkart Pay Later, the next time you go to buy something, you will see this option at the time of payment.

Step 1: Choose the product of your choice and add it to the cart.

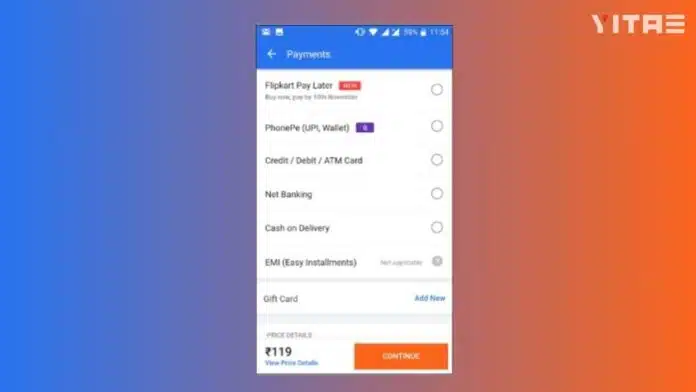

Step 2: Checkout and go to payment options.

Step 3: Select “Flipkart Pay Later”.

Step 4: Confirm the order and you are done!

This means – the whole formula of “Pay Later, Shop Now” is in your hands.